Excessive Government Spending: Are We Heading Towards the Next Financial Crisis?

March 23, 2016

© 2016, by Daniel T. Jordan, ASA, CBA, CPA, MBA

This article is published by QuickRead NACVA in two parts, April 13, 2016 and April 20, 2016.

As a valuation economist, I feel competent addressing this topic. I have gained insight into the following issues from having performed business valuations since 2000 and from relying on my strong education in business administration and economics.

In this article, I explain many of the issues being discussed in the media and political debates such as fiscal policy, monetary policy, government spending, national debt, the Gross Domestic Product (GDP), taxes, interest rates, unemployment, inflation, deregulation, free trade, capitalism vs. socialism, and their impact on the national wealth. Thus, this is a lengthy but very informative article, which is worthwhile reading. There is so much confusion today in our society about how to maximize national wealth that I feel compelled to help enlighten the general public about these topics.

To answer the question noted in the title of this article, I will provide a short and long answer. The short answer is yes, if we continue along the same path without drastic changes. For the long answer, the reader will have to continue reading.

To answer the question noted in the title of this article, I will provide a short and long answer. The short answer is yes, if we continue along the same path without drastic changes. For the long answer, the reader will have to continue reading.

But first, let me tell you about an encounter I had at the gym. I found myself discussing the economic effects under Democrats vs. Republicans with a fellow I was working out with. He mentioned that he is going to vote for the Democrats because he works for the government and he does not want to lose his job.

There is something fundamentally different between me and this person. He looks at the economy from his personal perspective. He looks at what is most advantageous for him personally. Whatever maximizes his own profit becomes his agenda and opinion.

As an economist, I am trained to look at the economy from the national perspective. We look at the economy by analyzing how to maximize the output for the nation and the world, not for a particular group or individual. We ask what is best for the country as a whole, as opposed to me personally. Maybe the reader will think it is easy for me to say this since I do not work for the government. True, however, my wife is a state employee. And while my wife benefits from the Government, my opinion is not based on that. My opinion is based on what is good for the nation as a whole. This is based on my training and it influences the formation of my political views.

Now let’s get started:

A business owner wants to maximize the profits of the business. How does (s)he achieve this? The formula is:

Profits = Income – Expenses

Thus, (s)he can maximize profits by increasing income or reducing expenses.

How do we increase the national wealth? For the national economy, we talk about the “Output” of the economy. The output is the quantity of goods or services produced in a given time period. Calculating GDP is the most popular measure of national output.

The formula is as follows:

National Output (GDP) = Consumption (C) + Investment (I) + Government Purchases (G) + (Export less Import) (X-M)

We can increase the output by having more consumption, investment, more government spending, or more net exports.

The question is, should we focus more on C, I, G, or (X-M)?

Government spending includes all government consumption, investment, and transfer payments. Government spending can be financed either by government borrowing or taxes.[i] Changes in government spending are a major component of fiscal policy used to stabilize the macroeconomic business cycle.

For fiscal policy, increases in government spending are expansionary, while decreases are contractionary. John Maynard Keynes (1883–1946) was one of the first economists to advocate government deficit spending (increased government spending financed by borrowing) as part of the fiscal policy response to an economic contraction. According to Keynesian economics, increased government spending raises aggregate demand and increases consumption, which leads to increased production and faster recovery from recessions. Classical economists, on the other hand, believe that increased government spending exacerbates an economic contraction by shifting resources from the private sector, which they consider productive, to the public sector, which they consider unproductive.[ii]

Milton Friedman (1912–2006) was an American economist who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory, and the complexity of stabilization policy.[iii] While Keynes focuses on ‘G’, Mr. Friedman focuses more on the private sector (“C”, “I”, and “X-M”).

According to Mr. Friedman, Keynes tried to explain America’s Great Depression during 1929-1939 and therefore his theories need to be understood in the right context. In a depression, government should help with increased fiscal policy. But it is dangerous to apply Keynes theory in our day and age as I explain below.

Friedman was an advisor to Republican U.S. President Ronald Reagan and Conservative British Prime Minister Margaret Thatcher. His political philosophy extolled the virtues of a free market economic system with minimal intervention.

Reagan’s policies during the 1980s were clearly based on Friedman’s philosophy.

Reaganomics had four simple principles:

- Lower marginal tax rates

- Less regulation

- Restrain government spending

- Monetary policy devoted to stable prices (i.e., non-inflationary monetary policy)

While Reagan did not achieve all of those goals, he made good progress and the economy boomed under Reagan.

Friedman calls for free market economy, limited government (i.e., limiting the power of government and government spending), lower taxation and tariffs, and limiting government interference with market pricing mechanisms.

Government is needed for military and national defense to provide safety and security to the citizens. Government also provides the framework and the institutions (which are invisible) to develop free markets. For a successful and dynamic economy however, we achieve the best results through the free enterprise system with competition and private properties, without government interferences. Government interferences lead to imbalances in the markets.

There are exceptions though. The government needs to help those that do not participate in the market place (the young, old, and disabled). At the same time, the government needs to make sure the social element is not being abused and the incentives to work legally are still in place.

But let’s be clear, the exceptions are not the rule. The rule is having free markets and free trade. The knowledge lies within the market participants (i.e., the people) and not with bureaucrats. The tremendous increase in our living standards is almost entirely due to the private market and not the government. The market defines the allocation of resources and not a government agency, which is political. This is why nations with free market economies are much more prosperous than socialist states.

Most economists would agree that socialist countries have failed to accomplish their stated aims. Or, I can put it this way, all socialist countries have massively struggling economies and are taking away some, if not all, of the liberties of the people.

Having grown up in Germany, I remember very well the time of the German Reunification in 1990. I grew up in West Germany and have visited East Germany after the fall of the wall. The difference between East and West Germany was obvious. West Germany with largely a free market economy was technologically advanced with a high standard of living, while East Germany with its centrally-planned economy looked like Post World War II.

The major problems with socialist economies (centrally-planned economies) are the lack of incentives for growth and inefficiency in the distribution and allocation of resources.

Back to Keynes, a major concern with Keynes is that a lot of politicians like his theory on fiscal policy as it gives them an intellectual basis to justify their political agenda, which benefits them but not the nation. Politicians want to be elected. That’s their agenda. And, if certain fiscal policies help them to become elected, they will use them. But they are doing a disfavor to the public. We need to educate ourselves and others so that we are not fooled by clever politicians into supporting poor fiscal policy.

The issue with using poor fiscal policies is also that it leads to increased government spending (such as the creation of new government agencies) that is difficult to reduce later on. This is because there are not many groups that will advocate for reduced spending for their own group. You mainly find groups advocating in favor of government agencies but not the other way around. What happens is that government spending leads to more government spending.

Government Spending

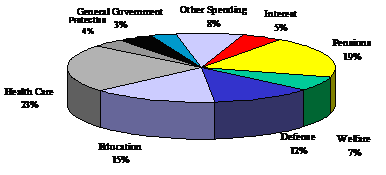

For FY 2016, the three biggest government programs (federal, state, and local) are health care, pensions, and education.[iv]

Government spending at the start of the 20th century was less than seven percent of GDP.

It vaulted to almost thirty percent of GDP by the end of World War I, and then settled down to ten percent of GDP in the 1920s.

In 1928, the total government spending in U.S. at all levels (federal, state, local) was about eleven-twelve percent of GDP,[v] with federal about three percent of GDP,[vi] and state and local about seven-nine percent of GDP.[vii]

In 2015, total U.S. government spending at all levels (federal, state, local) was about thirty-six percent of GDP.[viii] In 2015, total U.S. government spending, was “guesstimated” to be $6.4 trillion, with federal $3.7 trillion (about fifty-eight percent of the $6.4 trillion), and state and local $3.4 trillion (about fifty-three percent of the $6.4 trillion).[ix] This means the portion of federal government spending in 2015 is about twenty-one percent of GDP [58% x 36%]. This is seven times as much as 1928 when the federal portion of government spending was only three percent of GDP.

However, this figure understates the fraction of the resources being absorbed by the political market, because in addition to the government spending, government mandates many more expenditures on all of us, which government never used to do back in the 1920s and 1930s. For example, the government requires us to pay for anti-pollution devices on automobiles, clean air requirements, aid for disability, and many others.

If we add on the costs imposed on the private economy, at least fifty percent of total productive resources of our nation are now being organized through the political market. In that sense, we are more than half socialists.[x]

Economic Market vs. Political Market

The economic market is operating under the incentive of profit. The political/government market is operating under the incentive of power.

The importance of the economic market has declined in terms of the fraction of the country’s resources that it is able to use. The importance of the government/political market has greatly expanded. We might be wealthier today than seventy years ago, but we are less free and less secure.

Why is Government Constantly Growing?

There is a shift in public attitude and public opinion in the past seventy years with respect to the role of the individual on one hand, and the role of the government and collective institutions on the other hand.

Milton Friedman humorously states: “Everybody knows with the fall of communism, socialism was a failure. Everybody in the world agrees that capitalism was a success. And every capitalist in the world deduced from that, what the west needed is more socialism.”

There is a shift in the philosophy and attitude from public belief in the society in which the emphasis was on individual responsibility and the role of government as “Empire”, to a belief in the society in which the emphasis is on social responsibility and the role of government as “Big Brother” and protector of the individual.

We rely more and more on government and less on the individual. According to Milton Friedman, if we continue on the road we have been going and continue to rely more and more on government and less and less on the individual, we are condemned to a future of tyranny and misery. He said this back in 1993. What would he say today in 2016?

How Much did the U.S. Economy Grow?

According to the Bureau of Economic Analysis, the real GDP[xi] increased at an annual rate of 1.0 percent in the fourth quarter of 2015.[xii] This is very low.

Everybody wonders why our productivity and economic growth is so low. After having laid out the fundamentals above, I think we now know the reasons.

The government became too big and too powerful. We have too much government spending, too many rules and job-killing regulations, and too high taxes. This results in waste, inefficiencies, rise in unemployment, and many other problems. We are being taxed at fifty percent or more when including the costs imposed on the private economy by rules and regulations (which is an indirect tax). This means half of our income for which we work very hard goes to the government. I can say it differently, six months of the year we work for the government, and the other six months we work for ourselves. Essentially, this means the private economy became an agent of the federal government.

This is not a very conducive environment for growth. To make things worse, according to Milton Friedman, half of the taxes we pay are being wasted by the government. And, there are politicians that want to increase the taxes to even higher levels. This does not create jobs and incentives for growth. Instead, this leads to further unemployment as it makes it harder for businesses to expand or stay in business. If the taxes are too high, the formal market shrinks and the black market gets bigger, in which case the government loses in tax revenues. Thus, raising taxes is counter-productive. Rather, the federal government should cut taxes so that businesses can grow and hire more people. Additionally, with lower taxes, people have more money in their pockets, which would result in increased consumption, which leads to increased production and economic growth.

Moreover, the government needs to clean the tax code again as was done with the Tax Reform Act of 1986 under Ronald Reagan, which was followed by twenty years of growth. The current tax code works against industry and innovation. We have been accumulating too many special interests, crony capitalism, and political favoritism that corrupt the system.

A vibrant and dynamic economy creates incentives for growth and self-development rather than a mentality of entitlements. We need to bring back the spirit of entrepreneurship as this is what creates jobs and economic growth. In this area, the private market does a much better job than the government. The government is not very efficient. In the private sector, the business owner is responsible when conducting his business as his money is at risk. However, bureaucrats show less concern than the taxpayers since the tax payers are the ones that pay for failed investments and not the bureaucrats. Using Milton Friedman aphorism: “Nobody spends somebody else’s money as carefully as he spends his own.”

When Benjamin Netanyahu started as the Finance Minister of Israel, the state of Israel was facing major economic trouble. Under his leadership, he made dramatic economic changes. He came to the realization that to improve the private sector, it was best to cut government spending. This turned out to be the right path. Today, because of Israel’s high-end technology/innovation, and free market, Israel has a booming economy. Research/innovation/technology however is not enough. It needs to be combined with the free market principle to achieve high economic results. The Soviet Union had tremendous emphasis on education and research. But they did not have free markets, which is why there was not much progress. A good economy needs two things: good products/services and the free market to be able to sell products and services.

Imagine there are two light weight and two heavy weight soldiers. The light weight soldier is instructed to carry the heavy weight soldier for a mile. The heavy weight soldier is then instructed to carry the light weight soldier. Who will win the race? It’s obvious. The light weight soldier that carries the heavy weight person will collapse after a few steps, while the heavy weight soldier that carries the light weight person will make it to the end.

The same is true with the government. The government does not generate goods or services, but the private market does. The government is a cost to the nation. As stated above, government spending is financed either by borrowing or taxes. It is the private market that carries the government. Thus, it is fundamental that the private market be bigger than the government, otherwise, it gets crushed by the government.

I think this is what is happening today in the U.S. and with many other countries as well. The U.S. government became too big and this has negative effects on the private sector; therefore, the U.S. economy is growing only minimally.

If we want to honestly try fixing our economy, we need to find ways to reduce government spending and the national debt. We need to bring down government spending to the ten-twenty percent level in order for the private market to flourish again. The solution is not raising taxes coupled with more borrowing, as this makes things only worse. We have to get back to the roots and understand the private market is the one that brings forth jobs, economic growth, and prosperity; not the government.

How much is the U.S. debt?

The United States debt was at $10 trillion back in 2008. Currently, the national U.S. debt is at $19 trillion and at the end of FY 2016, the total government debt in the United States, including federal, state, and local, is expected to be $22.4 trillion.[xiii]

This means the national debt doubled in the last eight years of the current administration. More government spending will lead to more debt but the debt cannot grow forever. If the government continues its path of continued spending and increasing debt, the U.S. Government will default on its debt and this will cause a depression around the world. We already experienced the negative effects of Greece’s debt crisis, which is a tiny country compared to the U.S. A default by the U.S., the largest economy in the world, would cause the worst financial crisis the world has ever experienced in human history.

Due to the high debt, the Federal Reserve has to make sure to keep interest rates low because the U.S. cannot afford paying the debt at higher rates. The government hoped that by lowering interest rates, the economy would experience a boost through increased investments. Then the U.S. would be able to pay off some of its debt. However, the major boost did not happen. Some economists say that savings are necessary as well. However, due to low interest rates, there are no savings.

How are interest rates kept low?

With the financial crisis reaching a pitch in 2008, the Federal Reserve took to flooding the financial market with dollars by buying up bonds. This is called the Federal Reserve Bank’s “quantitative easing” asset purchasing program (i.e., expansionary monetary policy). Simultaneously, interest rates fell dramatically, as bond yields moved in the opposite direction from bond prices. The Fed poured billions of dollars into the bond market causing the Fed’s balance sheet to go from $2.1 trillion to $4.5 trillion. However, we have not seen the expected growth in GDP we hoped for from these low interest rates. The stock market benefited from the low rates as the banks barely pay any interest on savings. The S&P 500 doubled in value from November 2008 to October 2014, coinciding with the Federal Reserve Bank’s “quantitative easing” asset purchasing program. But the significant growth in the stock market, stimulated by artificially low interest rates, is vulnerable to bursting as stocks get overpriced. Since the Fed stopped buying bonds in late 2014, the S&P 500 has been very volatile, fluctuating in the sixteen percent range, and as of the day I am writing this article (March 2016), it is more or less where it was when the QE came to a close.[xiv]

Will interest rates stay low?

Interest rates cannot stay low forever. Eventually, they need to be raised to normal levels. If not, we will face other problems. Due to the Fed’s expansionary monetary policy, there is a lot more money in circulation. While in the short term, an expansionary monetary policy leads to lower interest rates, in the long term, it leads to inflation. With inflation, the interest rates will go up. Otherwise, the banks will stop lending money. In an inflation environment, the lender loses and the borrower wins. Thus, the lenders will demand a higher rate to account for inflation. But with higher interest rates, the U.S. cannot make payments on its debt.

With higher interest rates, the Government will face a dilemma. The Government needs to increase the taxes or go further into debt; neither of which are a solution. The Government will not be able to raise taxes, as the taxes are already too high. The U.S. has the third highest general top marginal corporate income tax rate in the world at thirty-nine percent, which is the same as Puerto Rico and is exceeded only by Chad and the United Arab Emirates.[xv] Further increases in taxes will destroy businesses. Higher investing taxes will hurt economic growth by disincentivizing investment. The big corporations and the rich will leave the country. Tax evasion is another problem because rich people have the resources as well as the incentives to avoid paying taxes. More people will work in the black market. That is a loss to the economy and raises the federal deficit. The capital that is bitterly needed to be invested here in the U.S. to create jobs would instead flow abroad. All this would result in more unemployment, less growth, and less tax revenues. Thus, raising taxes is counterproductive.

We have an exorbitant high national debt. Our politicians are not able to balance the budget. The interest rates are still at a historicaly low level. There are no savings. The expected increase in investments did not happen. The stock market is volatile and we could face another recession. While the federal debt per taxpayer from 2004 to 2015 increased an average of 7.2% per year,[xvi] wages continually remain stagnant. The real (inflation-adjusted) median household income has not gone up in the last sixteen years. In fact, it is below the peak set in 1999.[xvii] The nation’s poverty rate remains high. Forty-six million Americans are receiving food stamps.[xviii] The five percent official unemployment rate, as released by the Government, is misleading as it excludes those that gave up looking for jobs. The economy is not growing enough and the nation’s debt increases each year. And politically, we are facing major dangers in the world. In other words, we are living in difficult and challenging times.

What is the solution to the economical problems?

In my opinion, the U.S. must reduce its public debt (preferably before interest rates rise). Otherwise, the U.S. might default on its debt in the future. The problem, however, is that our politicians have a spending issue that causes them to constantly raise the debt ceiling. This issue is not addressed competently by the government.

The only way to steer our country correctly is by dramatically changing the course of this government by reducing government spending and regulations that negate business growth, and reforming the tax code. We will need good leaders who understand this and follow through. The public will need to understand that freebies and big government giveaways are not the solution to our problems. They will only make things worse. Milton Friedman used to say “’There is no such thing as a free lunch, with the exception of free markets”.

Limiting the power of government and reducing government spending will achieve two goals: 1) it will help lower the national debt; and 2) in combination with tax reform and lower taxes, it will boost the private sector. We will see growth again. And eventually, the Federal Reserve can again raise the interest rates to normal levels, which will allow savings.

Summary

To fix the problem, we need to understand the root of the problem. We cannot solve the problem by treating the symptoms. Our economy is weak due to big government, excessive government spending, high taxes, and costly rules and job-killing regulations. Socialism is not the solution; it only aggravates the problem. We need a strong private market; one which creates goods and services.

Currently, our free market and competitive position are compromised due to interference from the government, special interests, and political favoritism. The solution is a free market economy with efficient markets and competition; which we achieve through reduction in government spending, limiting the power of government and trade unions, deregulation, tax reform, lower taxes, and creating more incentives for growth, self-development, and reigniting the spirit of entrepreneurship. This in turn will revive small businesses, create new jobs, and make the nation more productive. The growth will result in higher income and wages across all classes, and a better standard of life. It is economic growth that generates new government revenues, through which we are able to reduce the national debt and become politically stronger in the world. Finally, less government is more freedom.

Endnotes

[i] There is actually another component, which is seigniorage.

[ii] https://en.wikipedia.org/wiki/John_Maynard_Keynes

[iii] https://en.wikipedia.org/wiki/Milton_Friedman

[iv] http://www.usgovernmentspending.com/us_20th_century_chart.html

[v] https://www.youtube.com/watch?v=77fdRWpV_-4, speech by Milton Friedman, 1993.

[vi] Half of which was used for the army and navy.

[vii] Half of which was used for schools and roads.

[viii] http://www.usgovernmentspending.com/us_20th_century_chart.html

[ix] And Intergovernmental is negative $0.6 trillion.

[x] Milton Friedman, 1993.

[xi] That is to say, the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes.

[xii] http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm

[xiii] http://www.usgovernmentdebt.us/

[xiv] https://finance.yahoo.com/news/the-fed-caused-93–of-the-entire-stock-market-s-move-since-2008–analysis-194426366.html

[xv] http://taxfoundation.org/article/corporate-income-tax-rates-around-world-2015

[xvi] http://www.forbes.com/sites/mikepatton/2015/04/24/national-debt-tops-18-trillion-guess-how-much-you-owe/#2857b3235ebd

[xvii] https://research.stlouisfed.org/fred2/series/MEHOINU.S.672N

[xviii] http://www.U.S.today.com/story/news/2015/05/12/benefits-food-stamps-fewer/27175881/